British Minister of State for International Trade, Greg Hands gave the key note address at the event titled –’Regeneration and infrastructure investment in a land alive with opportunities’ today, 10 August.

The 800 delegates travelling to the UK includes noteworthy high net worth investors, looking to invest in residential and infrastructure developments across the country. As the government plans £500 billion of public and private investment into infrastructure, Department for International Trade (DIT) will be showcasing key investment opportunities which will benefit the UK and Indian investors and help regenerate large parts of cities like Leeds, Manchester and Nottingham.

International Trade Minister, Greg Hands said:

I am delighted to meet India’s leading real estate developers, who are a testament to the fantastic track record of Indian investment in the UK. The UK is committed to ensuring that, as one of the fastest growing economies in the world, India has our full support to invest and succeed here.

Through a series of strong investments, like from Mumbai-based Lodha group who are expanding their business in the UK, India remains one of the top 5 investors into our country, securing and safeguarding thousands of jobs.

I look forward to joining with my Indian colleagues to further advance the mutually beneficial relationship between our 2 countries.

The market value of the UK’s real estate is over £1.6 billion, representing 21% of total net wealth, and the UK remains by far the most popular destination for global real estate investment in Europe. Real estate contributes £94 billion to the UK economy, accounting for 5.4% of GDP, and making a huge contribution to employment and regeneration.

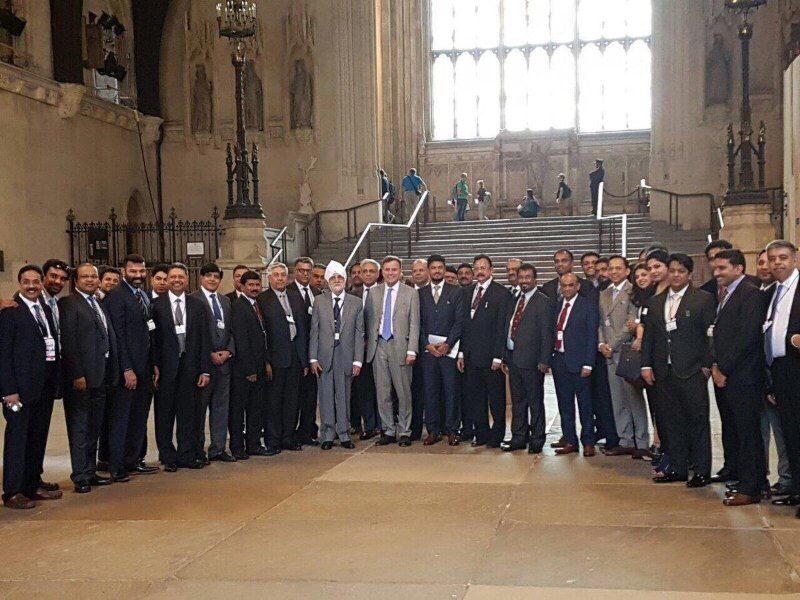

House of Lords member, Lord Ranbir Suri delivered the welcome address at the House of Lords and introduced the trade minister. The Indian attendees are part of a delegation of 800 Indian realtors, developers and promoters who are in the UK to participate in the annual international convention of the Confederation of Real Estate Developers’ Associations of India (CREDAI).

The convention is being hosted in London for the first time, following cities including Moscow and Shanghai, with total investment from CREDAI’s 12,000 members reaching billions of pounds in India and across the world. DIT experts will attend the event to promote bilateral infrastructure trade and investment opportunities between the UK and India and advise on the ease of doing business in the UK’s housing and real estate sectors.

Delegates will also be touring the UK, visiting the Northern Powerhouse and Midlands as well as Scotland to look at real estate and infrastructure investment opportunities in local towns and cities. According to DIT figures released this summer, the UK secured more inward investment projects in the last year than ever before, with 127 projects coming from India, creating and safeguarding 11,644 jobs.

Read more